Every manufacturer has its own way of putting together an electric vehicle (EV) battery pack, and every manufacturer must consider the fire safety of its batteries. While EV fires are a very rare event by miles traveled, it does not mean that manufacturers can ignore the issue. A combination of public perception, shifting regulations, financial impact, and general consumer safety are driving manufacturers to put an increased focus on the fire safety of EV batteries.

Several factors can influence battery safety, including cell chemistry, cell format, thermal management strategy, and many more. Even with all the above optimized, there is always a non-zero risk of thermal runaway occurring in a Li-ion battery. That is why a key method of enabling EV battery fire safety is the adoption of passive fire protection materials. These materials are designed to limit thermal runaway propagating between battery cells and/or prolong the time it takes for a fire to exit the battery pack. Thanks to the increased fire safety focus from OEMs and the rapidly growing EV market, passive fire protection materials and their suppliers will see a large opportunity within the evolving EV market. IDTechEx has recently published a report dedicated to Fire Protection Materials for EV Batteries, with a deep dive into the materials used, benchmarking, market shares, and forecasts for the next ten years.

Which Fire Protection Materials Are Used Where?

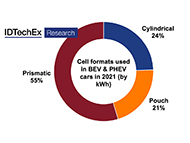

First, one has to consider which cell format is being used, cylindrical, pouch, or prismatic. The rectangular, very stackable form of prismatic cells generally leads to the use of materials applied in a sheet or pad form between the cells. This is a similar story for pouch cells, but the expansion and contraction of the cells during charge/discharge cycles have to be more carefully considered. In these applications, thin sheets of electrical insulation have often been used, and for pouch cells, a foam compression pad is generally included. As manufacturers aim to improve fire safety, energy density, and manufacturing simplicity, the use of materials that can provide more than one function becomes increasingly attractive.

This is a reason that increasing adoption of aerogels has been observed. The key selling point of aerogels is that they provide excellent thermal insulation, a key reason for its application in industrial environments. However, key players in the aerogel market, such as Aspen Aerogels, have also highlighted the mechanical properties that make it ideal for use as a compression pad too. At the same time, players that have been very active in supplying compression pads, such as Rogers Corporation, have created new products that include fire protection benefits, acting as a “drop-in” solution for an existing battery design.

Battery packs using cylindrical cells accounted for 24% of the electric car market in 2021, and their material use is quite different to pouch and prismatic packs. As the cells cannot be stacked together so simply and do not need to consider expansion/contraction to the same degree, the fire protection material must fulfill a somewhat alternate role. The most popular choice for cylindrical cell packs will be the use of an encapsulating foam. These foams fall into the multi-functional category, providing thermal insulation, fire protection, and structure for the cells. The vast size of battery packs in larger vehicles like cars, buses, and trucks means the low density of these foams is also a key benefit.

However, foams are not the only option for cylindrical cell packs. Smaller battery packs can prove more challenging for thermal management thanks to less space and funds to incorporate active cooling systems. Here, the use of encapsulants or phase change materials that can provide thermal conductivity and fire protection has a good use case. While the volumes may not be as large as the automotive market, with IDTechEx expecting over 90% of EV battery demand in 2033 to be accounted for by battery-electric cars, there is rapid expansion in these vehicle segments like electric scooters and motorcycles, leading to a significant opportunity. IDTechEx’s research has found that yearly revenue for fire protection materials, outside of automotive, will grow 15-fold over the coming decade.

In addition to these inter-cell materials, all battery packs can utilize materials at a pack level, either as a sheet between the cells/modules and the lid or as a coating applied to the battery enclosure. It has been common to observe ceramic blankets, mica, or aerogels applied as sheets and various coating technologies, such as intumescent coatings, applied to provide a final layer of fire protection between the battery cells and the vehicle itself. With the market drivers already discussed, IDTechEx is predicting that all of these materials will see increased demand, with pack-level fire protection materials presenting 15.6 times the yearly demand (in kg) in 2033 compared to 2022.

IDTechEx predicts that many of the existing materials used will continue to retain a large market share, but there are several material markets that will significantly grow their market share in a rapidly expanding market. IDTechEx’s latest report on “Fire Protection Materials for Electric Vehicle Batteries 2023-2033” provides material benchmarks and ten-year market forecasts across material categories, including ceramic blankets/sheets (and other non-wovens), mica, aerogels, coatings (intumescent and other), encapsulants, encapsulating foams, compression pads, phase change materials, and others.